Services

.6cb9a2817897bb4eef0d04e31be24f94.svg)

Book Keeping

Crawley Accountants Ltd take away your headache and

provide you with quality book keeping services tailored to suit

the specific needs of your business ..

.6cb9a2817897bb4eef0d04e31be24f94.svg)

.de3bd6a1f7265286854b6aea13b93908.svg)

Annual Accounts and Corporation Tax

With increased reporting obligations, more robust investigation policies on the part of the tax authorities, and harsher penalties for non-compliance, you could be spending an undue amount of your time and resources dealing with accounts...... Read More

Get Started.de3bd6a1f7265286854b6aea13b93908.svg)

Payroll

We provide a comprehensive and confidential payroll service, including: Registration with HM Revenue and Customs as an employer; Customised payslips; Administration of PAYE, national insurance, ...... Read More

Get Started

Business Advice

We understand the need of appropriate and most suitable business guidelines which are the part of every milestone in the life of a running business. Our guidelines help you to focus on your targets with proper planning and growth.

Get Started

.ae69218c21b8d956bb9761534067079b.svg)

Self Assessment

We can prepare and submit your personal tax returns, calculate your tax liability and can help you meet the deadlines for payments. As part of this process, we can analyse your self assessment tax return to see if any tax savings are ...... Read More

Get Started.ae69218c21b8d956bb9761534067079b.svg)

.efd74b9fd694037828643f24e7862a30.svg)

VAT

We offer an efficient, cost effective VAT service, which includes: Assistance with VAT registration, Advice on VAT planning and administration, Use of the most appropriate scheme, VAT control and reconciliation, ...... Read More

Get Started.efd74b9fd694037828643f24e7862a30.svg)

.7c59553ee55bbf651af219320d9c63e5.svg)

Company Formation

We help in the formation of new company by providing the services like advice on incorporation, assistance with shareholder agreement, registered Office, Company Secretarial service, VAT review and analysis etc.

Get Started.7c59553ee55bbf651af219320d9c63e5.svg)

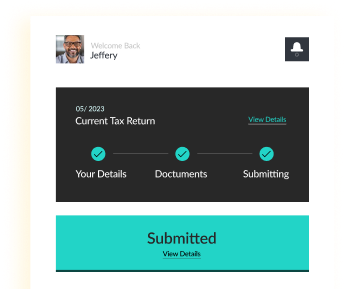

Painless tax returns

It’s a simple online process. Fast, efficient and a whole lot less scary than doing it yourself.

Peace of mind

No more worrying about missing a rebate or making a mistake. Get your return drafted by a real, accredited accountant.

One price

If you are self employed, your accounts, tax return and tax advice will all be for £99.'

.ee2db7cda786145f0dd69a50e5f9df1c.svg)

Prices/Fees

We recognise that clients prefer to have a fixed annual fee and we will be pleased to agree a fixed fee for our services before we commence work.The nature of the business, bookkeeping systems and the accounting requirements may not be the same for any two different clients. For this reason it may be difficult to estimate our fee without discussing your requirements first.We will provide you with a written fee estimate after a free no obligation initial consultation meeting. At this meeting we will try and understand your business, assess your requirements, discuss the accounting needs of the business and explain to you how we can assist you.